A bond premium occurs when market interest rate is lower than the bond's coupon rate and the bond sells at a price higher than the face value. As part of the bond issuance process, the issuer sets a coupon rate keeping in view the current market interest rate and its assessment of the credit risk of the bond. However, market interest rates are volatile, and the credit risk assessment might be different from the default premium investors require in the market.

Bond Yield Rate vs. Coupon Rate: What's the Difference?

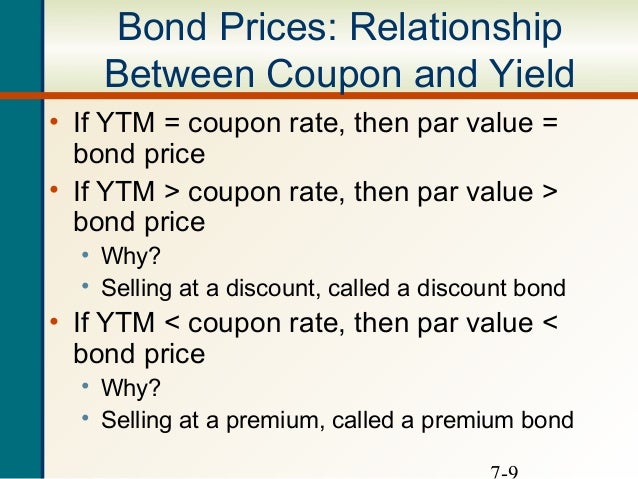

If the required return on a bond is higher than the coupon rate, the demand for the bond is low and it must be issued at a price lower than the face value. This represents issuance of a bond at a discount. If the market yield on the bond turns out to be 6. Where c is the periodic coupon rate i. The total amount of bond discount is directly proportional to the difference between the coupon rate and bond yield i.

Coupon (bond)

You will be required to amortize the bond discount over the life of the bond. This will result in your interest expense to be higher than the interest payment. Your will effective interest rate will be higher than the coupon rate. The difference represents the bond premium. Here we will ensure our readers get to know the basic difference between the two with help of proper examples.

For example a bond is issued with a face value of Rs 2,, and it is issued with semi-annual payments of Rs The coupons are fixed; no matter what price the bond trades for, the interest payments always equal Rs 40 per year. The coupon rate is often different from the yield. At face value, the coupon rate and yield equal each other.

Definition of 'Coupon Rate'

Bond yield and price share an inverse relationship Imagine Mr. X purchases a bond for Rs 1, The bond matures in four years. Therefore, it pays Rs 50 a year in interest.

X decides to sell his bond as he urgently requires his initially invested Rs Once he places an order to sell his bond, his order would enter the market and interested buyers would compare this particular bond with the other bonds in the market at that particular point in time. Since the interest rates must have gone up in the market after one year, a newly issued Rs bond with a maturity period of 4 years the time left for the bond from Mr.

This accounts for Rs 60 a year.

- Bond Discount and Premium | Calculation & Example.

- The Zero Coupon Bond: Pricing and Charactertistics.

- travel portland coupon book.

Interestingly, if an investor purchases bond from Mr. In short, there is no enticement for the investor to buy a bond of Mr.

X at the face value of Rs when he could make more profit after purchasing the new bond with an increased interest rate at same par value.