Brief facts are, the assessee an Indian company is engaged in the business of issuing meal, gift vouchers, smart cards, to its clients who wish to make benefit in kind for their employees. To verify the TDS compliance of the assessee, a survey under section A 2A was conducted in the business premises of the assessee on 21st January During the survey, the assessee was requested to furnish the details of payments made by it to affiliates. After perusing the details it was found that the assessee was deducting tax at source only in respect of payments made to caterers, whereas, no tax was deducted at source on payments made to other affiliates.

Therefore, the Assessing Officer issued a notice to the assessee directing it to show cause why it should not be treated as an assessee in default under section 1 for non-deduction of tax at source on such payment. In response to the show cause notice, the assessee filed a detailed reply stating that the provisions of section C of the Act are not applicable with regard to the agreement made with the 4 Sodexo SVC India Pvt. Being aggrieved of the order so passed, assessee preferred appeal before the first appellate authority, inter-alia, on the ground that the order passed under section 1 and 1A is barred by limitation as per sub-section 3 of section as was applicable for the relevant period.

In the course of hearing of appeal before the first appellate authority, it was submitted by the assessee that as per the provisions contained in sub-section 3 of section which existed prior to its amendment by Finance Act , , w. Thus, it was contended, by the time the show cause notice under section was issued to the assessee, already two years have expired from the end of relevant financial year wherein the statements were filed the proceedings are time barred.

- lt deals 1706.2;

- Income Tax Allowances & Deductions Allowed to Salaried Individuals;

- Income Tax Notice For Sodexo Coupons.

- dads root beer coupons;

- Easy and Accurate ITR Filing on ClearTax.

The learned Commissioner Appeals , though, agreed that as per pre-amended provisions of sub- 5. The learned Commissioner Appeals referring to the object behind the amendment to sub-section 3 observed that the legislature having found that there is no rationale behind limitation period of two years has amended the provision.

He observed, the provisions contained under section being machinery provision cannot be subjected to rigorous construction.

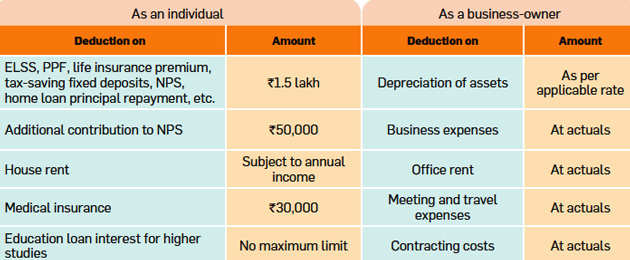

Income Tax Allowances and Deductions Allowed to Salaried Individuals

Referring to certain judicial precedents the learned Commissioner Appeals ultimately held that the amendment made to sub-section 3 of section by Finance Act , , being clarificatory in nature will apply retrospectively. Therefore, the extended limitation period of seven years will apply to assessee's case.

Accordingly, he upheld the validity of the order passed under section 1 and 1A. The learned Sr. Counsel, Shri J. Mistry, appearing for the assessee reiterated the submissions made before the first appellate authority.

Valuation Rule Under GST – Specific Businesses

Drawing our attention to the pre-amended provision of sub- section 3 of section , he submitted that in case of the assessee 6 Sodexo SVC India Pvt. He submitted, the Departmental Authorities have not disputed the fact that the assessee has filed its quarterly statement of TDS within the time prescribed under section of the Act. Therefore, the assessee will be covered by clause i of section 3 of section as it existed prior to its amendment by Finance Act , Learned Sr. Counsel submitted, by virtue of amendment to sub-section 3 of section by Finance Act , , the earlier provisions as contained under sub- section 3 was substituted by a new provision as per which the limitation period was extended in all cases to before expiry of seven years from the end of financial year wherein payments were made.

However, he submitted, the amended sub-section 3 of section of the Act was made effective from 1st October Counsel submitted, by the time the amendment to sub-section 3 of section was effected by Finance Act , , the limitation period as per the pre-amended provisions has already expired in case of the assessee. Therefore, the Assessing Officer could not have assumed jurisdiction for issuing a notice under section 1 and 1A. Counsel submitted, the impugned order of the Assessing Officer passed under section 1 and 1A being barred by limitation has to be declared as null and void.

TDS ON SODEXO, Income Tax

Learned Departmental Representative strongly relied upon the observations of the first appellate authority. We have heard rival submissions and perused materials available on record in the light of the decisions cited. So far as the factual aspect of the issue is concerned, there is no dispute that in terms of section 3 , the assessee has filed statements of TDS before the Department within the prescribed time.

In fact, in the submissions made by the assessee as reproduced in Para Therefore, we have to proceed on the basis that in assessee's case, the statements of TDS have been filed.

Keeping the aforesaid factual position in view it is necessary to examine the relevant statutory provisions. Wednesday, August 14, Back Popular Subject.

sodexo coupon tds

Back Publication. Back Popular Topics. Back Latest Circulars Notifications Orders.

Back Index Recent Topics. Back Search. Index Recent Topics Search. The case laws are open for discussion and we invite expert comments from our members on its applicability and effect on relevant issues. P tax new circular. Subject Category Recent Discussions. Sodexo Or Ticket Restaurant Coupons? Removal Of Meal Coupons.

- free vst deals;

- black friday deals bloomingdales;

- amazon india books coupons promo codes;

So which variable could I use? Professional Tax deduction - shall deduct professional tax from our Delhi managers salary. Toggle navigation Home. Contact Copyright Privacy.